Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

CONSUMER CONFIDENCE INDICATOR ASONE OF LEADING ECONOMIC INDICATOR

Annotation.Consumer confidence indices exemplify the potential contribution of the psychological dimension in economic science. Consumer confidence indicator under cognitive expression influence on economy. Its agenda is focused on understanding the role of the consumer in the transition economy and on analysis of consumer confidence index dynamic in Georgia.

The objective of research is to investigate the relationship between consumers' expectations about the future of the economy and economic growth. In other words is there relationship between psychological aspects and economy, is there influence consumer confidence index on aggregative economic indicator such economic growth. Changes in consumer confidence help to explain real economic variables and be the useful in helping to forecast the real economy.

Keywords: Consumer confidence indicator, forecasting, leading economic indicators.

Business cycle theories found their way into the economic theories at the beginning of 20th century. The research in this area was concentrated mainly at the National Bureau of Economic Research (NBER) in United States. The business cycles (calledsometimes economic cycles) are regular fluctuations of economic variables in market economies. There are two different approaches to the fluctuations: business cycles (classical view) and deviation cycles. The leading indicator became an important research tool of business cycle analysis mainly in the US and the member countries of OECD.

The classical view of business cycles is the simplest and most accurate approach in cyclical analysis. But the experience of many countries proves that a long-term slowdown of growth can cause more damage to the economy than the recession itself. In the second half of 20th century the classic business cycle didn’t even occur in some countries – the growth of the output in level continued without break. That’s why the attention is devoted also to deviation cycles (called also growth cycles) – fluctuations of time series around its long-term trend. The original time series have to be decomposed into four components – seasonal, trend (long-term), irregular and cyclical component. The objects of the cyclical analysis are the cyclical components of economic indicators with different time resolutions (leading, coincident, lagging). The time series decomposition is contrary to the classical cycle view connected with more inaccuracy. Compared to the classical view the interpretation of deviation cycles differs too. As we talk about expansion or recession in the classical view, deviation cycles describe only the slowdown or an acceleration of the economy. For instance all phases of the deviation cycle pass over during only one phase of the classical cycle (e.g. expansion). Nowadays the research in OECD countries is focused both on the classical as well as on the deviation cycle.

Since the pioneering work of Mitchell and Burns (1938), variable selection has rightly attracted considerable attention in the leading indicator literature, see, e.g., Zarnowitzand Boschan (1975) for a review of early procedures at the NBER and Department of Commerce.

Moore and Shiskin (1967) formalized an often quoted scoring system (see, e.g., Boehm (2001), Phillips (1998-99)), based mostly upon (i) consistent timing as a leading indicator (i.e., to systematically anticipate peaks and troughs in the target variable, possibly with a rather constant lead time); (ii) conformity to the general business cycle (i.e., have good forecasting properties not only at peaks and troughs); (iii) economic significance (i.e., being supported by economic theory either as possible causes of business cycles or, perhaps more importantly, as quickly reacting to negative or positive shocks); (iv) statistical reliability of data collection (i.e., provide an accurate measure of the quantity of interest); (v) prompt availability without major later revisions (i.e., being timely and regularly available for an early evaluation of the expected economic conditions, without requiring subsequent modifications of the initial statements); (vi) smooth month to month changes (i.e., being free of major high frequency movements) [Marcellino, 2005. 4].

Leading Economic Indicators includes ten measures that generally indicate business cycle peaks and troughs three to twelve months before they actually occur. The leading indicators (According NBER methodology) are:

- Hours of production workers in manufacturing; 2. New claims for unemployment insurance; 3. Value of new orders for consumer goods; 4. S&P 500 Composite Stock Index; 5. New orders for plant and equipment; 6. Building permits for private houses; 7. Fraction of companies reporting slower deliveries; 8. Index of consumer confidence; 10. Change in commodity prices; 11. Money growth rate (M2). This types of indicators are different by OECD methodology. Differences depend on country’s features. For example for Belgium there are: New passenger car registration; Employment (manufacturing) future trend; Export orders inflow; Demand; Production; Consumer confidence indicator. Also different are LEI for Poland: Real effective exchange rate; Interest rate; Production; Unfilled job vacancies; Production of coal. In some cases most part of indicates are related with psychological factors - as expectation of consumers, consumer confidence and etc. For example in case Netherlands there are 5 leading indicators in total, four of which are confidence indicators.

Consumer confidence indices exemplify the potential contribution of the psychological dimension in economic science. However, several areas for further research could be proposed to deepen our reflections. First, the choice of questions to be included in the composite indicator may impact upon the forecasting power of indices. Consumer confidence indicator under cognitive expression influence on economy. Its agenda is focused on understanding the role of the consumer in the transition economy.

Georgia signed the Association Agreements with EU and Euro Member States stability is very important as for their countries as for Georgia – country with transition economy. Given the volatile nature of transformed economy, there is a need for businesses and government agencies to have access to an accurate leading indicator of transformed economic performance (In particular for Georgia). Relations between macroeconomic variables are crucial as for individual countries growth as strong linkages economies.

The results show that, even with limited monthly observations, it is possible to establish meaningful economic and statistically significant relations between indicators from different sectors of the economy and the present and future direction of economic activity. To detailed information on consumers’ financial situation, forecasting models require information on the economic and psychological factors that shape changes in their spending and saving decisions. Is captured that is there relationship between consumers' expectations about the future of the economy and while economy. In other words is there relationship between psychological aspects and economy, is there influence consumer confidence index on aggregative economic indicator such economic growth.

The importance of expectations for the explanation of consumption decisions was also reflected in independent advances in economic theories, sparked by the work of two Nobel laureates. Friedman’s permanent income hypothesis (1957) and Modigliani’s life-cycle theory (1954), emphasized the role of expectations in determining consumers’ current spending and saving decisions. The factors influencing consumer confidence were personal financial circumstances, group membership, political attitudes and information [Savin I., Winker P. (2011). 7].

The analysis of this indicator can help policymakers gauge the short-term direction of economic activity. While such analysis is well established in advanced economies, it has received relatively little attention in many emerging market and developing economies, reflecting in part the lack of sufficient historical data to determine the reliability of these indicators.

The relevance of consumer confidence has been widely Investigated in the economic literature. The evidence on the relevance of consumer confidence in addition to the information contained in other economic indicators is mixed.

Several studies, though, suggest that consumer sentiment has predictive power not possessed by economic indicators. The sentiment indicator is found to be particularly informative under circumstances of strong fluctuations in the economy. Broadly speaking, there are two complementary views: the information view and Keynes’ animal spirits view . The information view regards consumer confidence as a representation of rational future expectations.

Theoretically, any role given to consumer confidence to explain future spending is not consistent with rational economic expectations (Hall, 1978). This means that explanations of the predictive power of consumer confidence have to be found outside of the rational expectations theoretical framework with frictionless markets. For example, borrowing constraints can prevent the consumer from consuming more today in anticipation of the increase in income [Banerjee A., Marcellino M., Masten I. (2006), 1].

As consumer sentiment can be updated almost instantaneously, its prime value added is that it is leading future economic developments, but does not independently affect these developments.

Consumer Confidence Index for Georgia - Consumer Confidence Survey by ISET follows the standard EU methodology: There are randomly sample 300-350 individuals on a monthly basis and question them about the past, current and future financial situation of their families and the country as a whole. Consumer confidence is the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. How confident people feel about stability of their incomes determines their spending activity and therefore serves as one of the key indicators for the overall shape of the economy. In essence, if consumer confidence is higher, consumers are making more purchases, boosting the economic expansion. On the other hand, if confidence is lower, consumers tend to save more than they spend, prompting the contraction of the economy. Data are available through the ISET survey. We try to indicate if consumer confidence closely related to GDP.

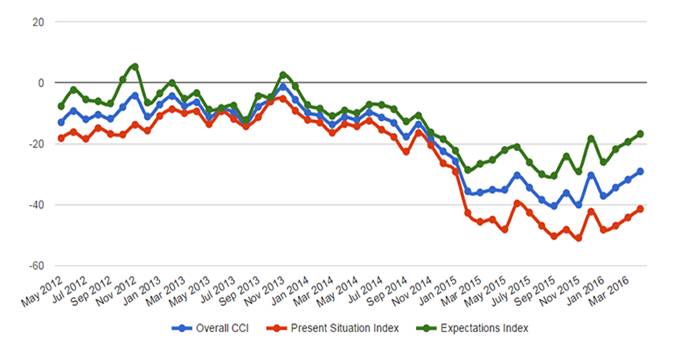

Consumer Confidence Index for Georgia

Source: http://www.iset-pi.ge

As we see on the chart above the consumer confidence index (CCI) continued to increase, sustaining the trend which started in January.

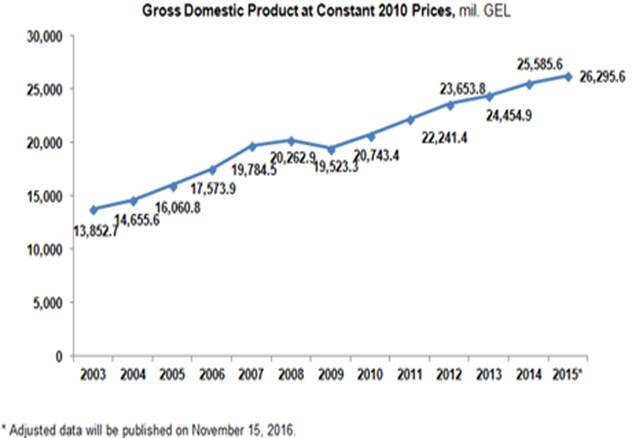

Source: geostat.ge

By this statistics we cannot discuss about close relation between GDP and consumer confidence index but in long-term period there might be positive relations. Changes in consumer confidence help to explain real economic variables and be the useful in helping to forecast the real economy.

References

- Banerjee A., Marcellino M., Masten I. (2006), Forecasting Macroeconomic Variables Using Diffusion Indexes in Short Samples with Structural Change. IEP-Bocconi University;

- FLOROS, Ch. (2005), Forecasting the UK Unemployment Rate: Model Comparisons. International Journal of Applied Econometrics and Quantitative Studies. Vol.2.-4;

- Fulop G. &Gyomai G. (2012), “Transition of the OECD CLI system to a GDP-based business cycle target”, OECD,

Available at: http://www.oecd.org/std/leading-indicators/49985449.pdf;

- Marcellino M. (2005), Leading Indicators. IEP-Bocconi University, IGIER and CEPR;

- Nilsson R., Gyomai G. (2007), OECD System of Leading Indicators (Methodological Changes and Other Improvements), Short-term Economic Statistics Division, OECD, November.

- Romer D. (2012) Advanced Macroeconomics, 4th edition, McGraw-Hill/Irvin;

- Savin I., Winker P. (2011).Heuristic Model Selection for Leading Indicators in Russia and Germany.Joint Discussion Paper Series in Economics coordinated by Philipps-University Marburg.

- Sorensen P. B. &Whitta-Jacobsen H. J. (2013), Introducing Advanced Macroeconomics: Growth and Business Cycles, 2th edition, McGraw-Hill.

- Zarnowitz V. (1992), Business Cycles: Theory, History, Indicators, and Forecasting, University of Chicago Press. Available at: //www.nber.org/books/zarn92-1;

- The Conference Board Leading Economic Index (LEI) for the United States and Related Composite Economic Indexes for July 2014.Available at https://www.conference-board.org/press/pressdetail.cfm?pressid=5265

- http://www.iset-pi.ge/index.php/en/consumer-confidence-index/1040-may-2015-cci-rising-consumer-expectations-point-to-a-somewhat-brighter-future